- Crypto Payroll Systems: The Future of Employee Compensation?

- Proven Debt Management Strategies 2025: Slash Your Debt and Boost Your Credit Score with Proven Tips

- Guide to buying a home in 2025: How Young Adults Can Move from Renter to Homeowner

- Plan Your Dream Retirement: 2025 Guide to Digital Retirement Planning

Financial Guide for Millennials and Gen z in 2024

Debt, saving, and adulting – welcome to the world of personal finance! This Financial Guide for Millennials and Gen Z is here to navigate the complexities of money management and help you build a secure future.

The world of finance might sometimes feel like trying to navigate a dense jungle without a map. Between student loans, the cost of living, and the looming specter of retirement (it’s never too early to think about it), managing money can seem daunting. We’re here to help you chart a course through the financial wilderness.

Navigating the Financial Jungle: Financial Guide for Millennials and Gen Z

- Understanding the Financial Landscape

Before diving into the details, let’s talk about where we are right now. First start by discussing the unique financial challenges and opportunities that’s presented in a platter:

Student Debt: Many of us are grappling with substantial student loan debt. It’s crucial to understand your loan terms and explore options like refinancing or income-driven repayment plans.

The Gig Economy: While it offers flexibility, it often lacks the stability and benefits of traditional employment. This means we need to be proactive about things like health insurance and retirement savings.

Digital Natives: We have unparalleled access to financial tools and information online. Use this to your advantage!

2. Building a Solid Foundation

Here are some basics to get your financial house in order:

Create a Budget: We all know—budgets can feel restrictive. But think of a budget as a way to ensure your money is working for you, not the other way around. Apps like Mint or YNAB (You Need A Budget) can simplify the process.

Budgeting doesn’t have to be a chore! Check out our guide to Budgeting Basics for Beginners: Mastering Money with Some Proven Methods for tips and tricks to make it painless.

Emergency Fund: Having an emergency fund is crucial for financial security. Aim to save at least three to six months’ worth of expenses. This fund is your safety net for unexpected expenses like car repairs or medical bills. Learn more about how to build a safety net that can cover unexpected expenses.

Debt Management for Millennials: Drowning in student loans or credit card debt? We’ve got your back. Our guide on Debt Management for Millennials explores different repayment strategies and how to prioritize your payments.

Prioritize paying off high-interest debt first, like credit card balances. Consider the snowball or avalanche method for debt repayment.

3. Investing for the Future

Investing isn’t just for the wealthy or the finance-savvy. It’s for everyone, and the earlier you start, the better.

401(k) or 403(b): If your employer offers a retirement plan, contribute at least enough to get the full match. That’s free money!

Learn more about retirement savings plans and how to contribute to it.

Roth IRA: This is a great option for those who think they’ll be in a higher tax bracket in the future. Contributions are made with after-tax dollars, and withdrawals in retirement are tax-free.

See if a Roth IRA fits you in our guide to The Power of Passive Income.

Index Funds and ETFs: These are low-cost, diversified options perfect for beginners. They track market indexes and are less risky than individual stocks.

4. The Power of Passive Income

Creating multiple streams of income can provide financial security and increase your wealth over time.

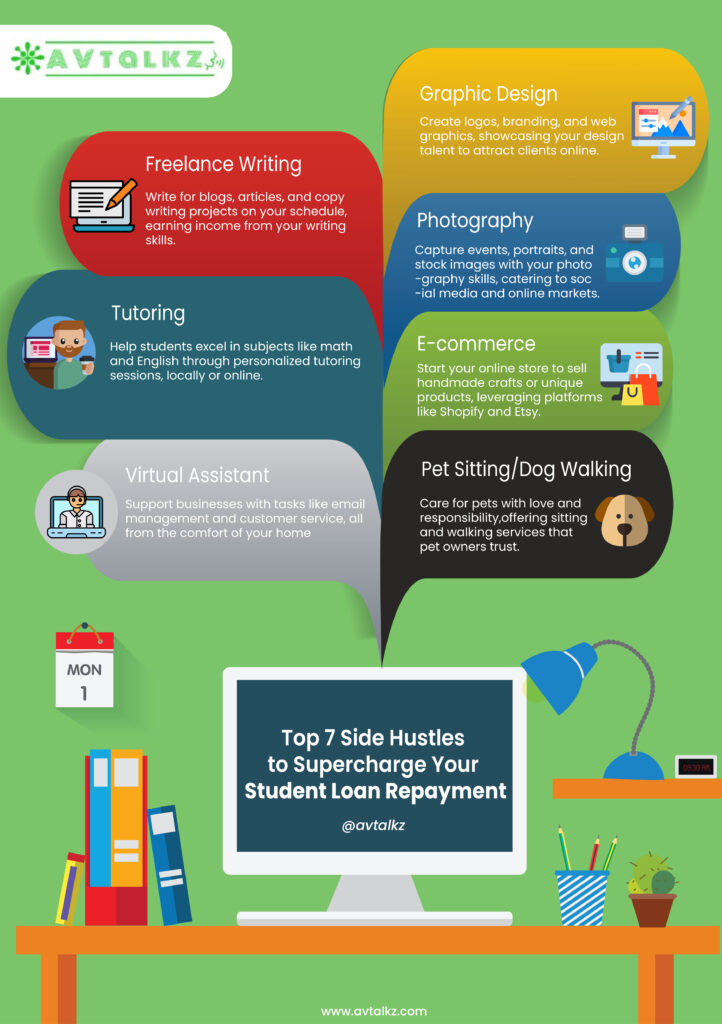

Side Hustles: Whether it’s freelance work, selling handmade crafts on Etsy, or tutoring, side hustles can boost your income.

Real Estate: This isn’t just for the rich. Platforms like Fundrise allow you to invest in real estate with as little as $500.

Dividend Stocks: Invest in companies that pay dividends. Over time, these dividends can provide a steady stream of income.

5. Mindful Spending

It’s easy to fall into the trap of lifestyle inflation—spending more as you earn more. Instead, try to be mindful of your spending.

Value-Based Spending: Spend on what truly brings you joy and cut back on the rest. This could mean fewer takeout dinners and more saving for travel.

Track Your Expenses: Regularly review your spending to see where your money is going. Small changes, like making coffee at home instead of buying it, can add up over time.

6. Stay Informed and Adapt

The financial world is constantly changing. Stay informed by reading books, listening to podcasts, and following finance blogs. Some of the favorites include The Financial Diet, ChooseFI, and Afford Anything.

Personal Story: From Side Hustle to Full-Time Success

Meet Jenna, a 28-year-old graphic designer who turned her passion into a thriving business. Jenna started by doing freelance design work on the side while holding down a full-time job. She used platforms like Fiverr and Upwork to find clients, steadily building her portfolio and reputation.

Jenna’s hard work paid off. After two years, she had enough steady freelance income to quit her full-time job and focus on her business. Today, she enjoys the flexibility of being her own boss and has tripled her income.

" If you have a skill or passion, consider starting a side hustle. It's a great way to earn extra income and potentially transition into full-time self-employment."

TIP

Financial Guide for Millennials and Gen Z: Your Roadmap to Crushing Student Loans (and Everything Else!)

Alex, a 25-year-old marketing professional, faced the daunting task of paying off $60,000 in student loans. Instead of feeling overwhelmed, Alex created a strategic repayment plan.

He also culled unnecessary expenses, like dining out and subscription services, and directed those savings toward loan payments. By using the avalanche method, Alex paid off all his loans in just four years.

" Prioritize your loans by interest rate and focus on paying off the most expensive debt first. Small sacrifices in daily spending can accelerate your repayment journey."

TIP

Financial Guide for Millennials and Gen Z: Smart Investing for Early Starters

Samantha, a 23-year-old software engineer, started investing right out of college. Despite having limited knowledge about the stock market, she decided to educate herself and take the plunge.

She also took advantage of her company’s 401(k) match, contributing enough to get the full employer match and setting up automatic contributions. Over time, she learned more about index funds and individual stocks, gradually increasing her investments.

"Don't be afraid to start investing, even if you have limited knowledge. Use resources like robo-advisors to get started and educate yourself along the way. Consistent, early investments can lead to substantial growth over time."

TIP

Building a Secure Future with Smart Spending Habits

It’s tempting to upgrade your lifestyle with every raise, but within this Financial Guide for Millennials and Gen Z, we’ll show you the power of delayed gratification. Maintaining modest living expenses while increasing your savings and investments will pay off in the long run. You’ll be surprised how much faster you can reach your financial goals by prioritizing your future over fleeting pleasures.

5 Additional Tips for Financial Success

Negotiate Your Salary

Most of us hesitate to negotiate our salaries, but it’s a crucial step in building wealth. Do your research and be prepared to discuss your contributions and market rates. You’d be surprised how often employers are willing to offer more.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures that you’re consistently saving and investing without having to think about it.

Build Your Credit

A good credit score can save you thousands in interest over your lifetime. Pay your bills on time, keep your credit card balances low, and avoid opening too many new accounts at once.

Educate Yourself

Financial literacy is key to navigating the complexities of money management. This Financial Guide for Millennials and Gen Z equips you with resources to build your financial IQ. Dive into books like “Rich Dad Poor Dad” by Robert Kiyosaki or “Your Money or Your Life” by Vicki Robin for foundational knowledge. Podcasts like “The Dave Ramsey Show” or “Bigger Pockets” offer ongoing learning and diverse perspectives. Remember, financial literacy is a journey, so keep exploring and learning as you go!

Live Below Your Means

It’s tempting to upgrade your lifestyle with every raise, but maintaining modest living expenses while increasing your savings and investments will pay off in the long run.

Financial Guide for Millennials and Gen Z: Your Journey to Financial Freedom Starts Now

Financial freedom is a journey, not a destination. It requires continuous learning, smart decisions, and sometimes, a bit of sacrifice. But with the right mindset and strategies, you can achieve your financial goals and enjoy the peace of mind that comes with financial stability.

Remember, every small step you take today can lead to significant progress tomorrow. Keep going, stay motivated, and don’t be afraid to seek advice and learn from others.